free crypto tax calculator uk

Now that you are clear on how to use our crypto tax calculator and what taxes you will pay on crypto consider how. Your tax authority wants to know your equivalent profits or losses in the local fiat USD GBP AUD or CAD.

Bitcoin Price Prediction Today Usd Authentic For 2025

The ultimate uk crypto tax guide 2020.

. Calculate and report your crypto tax for free now. Or Sign In with Email. Free for 1000 transactions but no tax reporting.

In many cases this sort of software also includes a complete crypto portfolio tracker and analysis tool to get a bird eye. Paid plans start at 49 per year for 100 transactions. It provides the most accounting transparency of any cryptocurrency tax calculator.

12570 Personal Income Tax Allowance. Crypto tax software is a tool that allows you to prepare your taxes for your cryptocurrency assets. Over the last decade cryptoassets have burst on to the investment scene and captured the imagination of investors all over the world.

EToro - Crypto Tax Calculator. Integrates major exchanges wallets chains. Your first 12570 of income in the UK is tax free for the 20212022 tax year.

How to calculate your UK crypto tax. Since then its developers have been creating native apps for mobile devices and other upgrades. Of course there is a wide range of tax reliefs and allowances to take advantage of so you are not hit with the full brunt of.

Beyond that level there are three tax brackets in the UK. Luna 20 Sell-Offs Crash Price. Best Crypto tax reporting and calculation software.

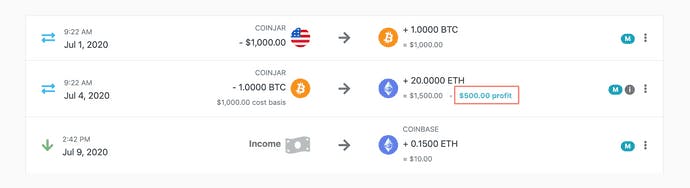

Join over 300000 crypto investors calculating their profits losses and tax liabilities today. Luna the cryptocurrency that collapsed the Terra blockchain has crashed in value after relaunching last week. To calculate tax on crypto-to-crypto transactions you have to calculate the value of each crypto in fiat.

Tax doesnt have to be taxing. Check out our free guide on crypto taxes in UK. With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today.

If youre looking to get started with a UK crypto tax calculator right away one of the following options is likely your best bet Koinly. May 17 2022. Basic tax rate of 20 between 12501 to 50000 income.

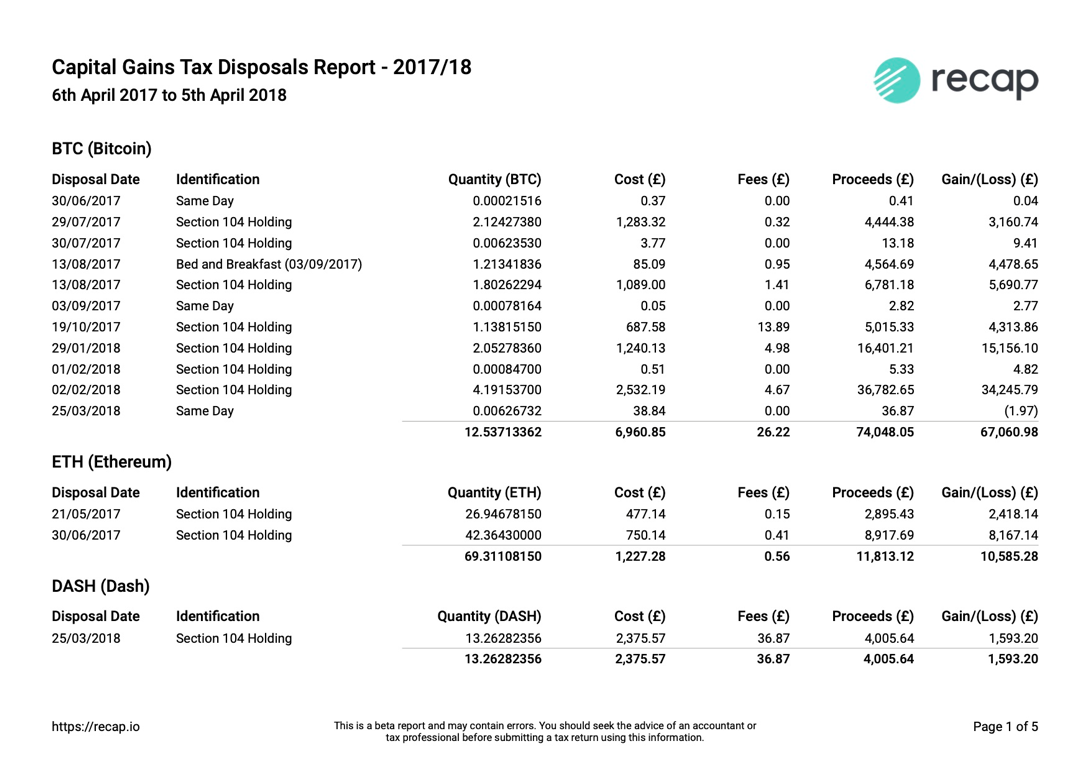

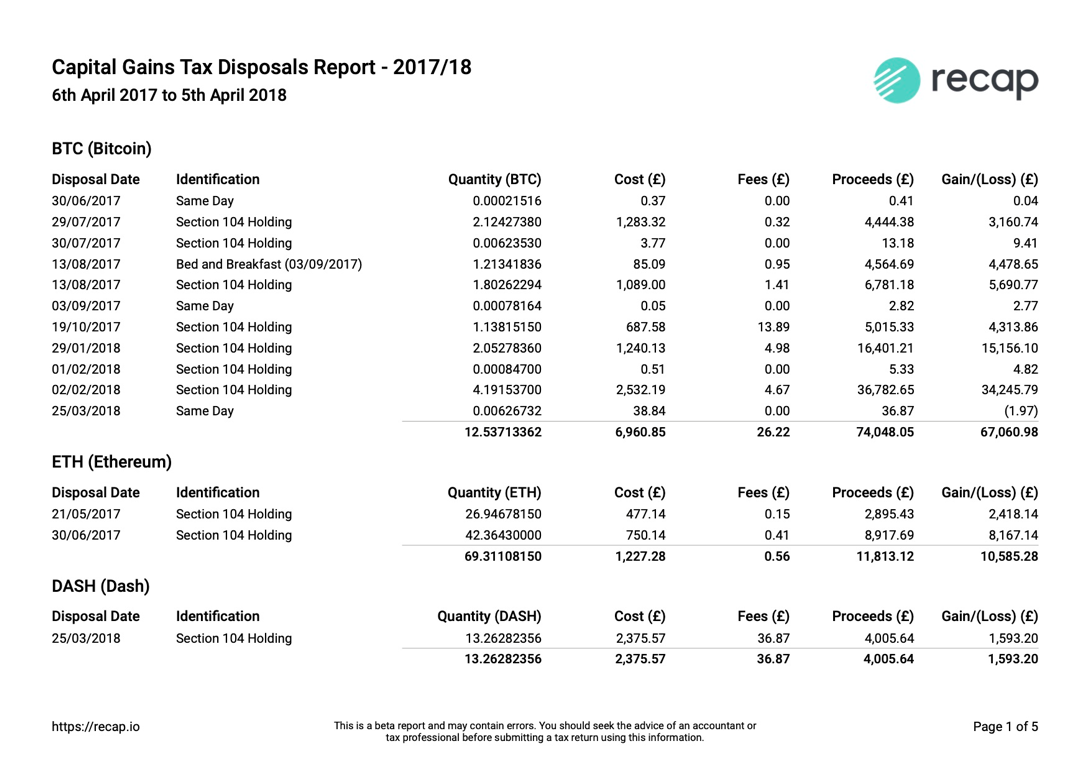

DeFi DEX trading. To report your crypto transactions and pay your capital gains tax you can use the HMRCs Government Gateway online service. Supports HMRC Tax Guidelines.

Additional tax rate of 45 beyond 150000. TokenTax is one of the most extensive tax calculation and reporting software out there for any crypto trader. The Annual Exempt Amounts are pictured below.

The Swyftx cryptocurrency tax calculator will ask you if youve held your crypto asset for 12 months. Higher tax rate of 40 between 50001 to 150000. It is the individuals responsibility to calculate any gains or losses through buying and selling.

The platform is also to start using Koinlys crypto tax calculator. This matters for your crypto because you subtract. We then sell the BTC realising a gain of 12300 in this tax year to maximise the tax free threshold.

Sign In with Google. Koinly is a popular platform with a crypto tax calculator available in over 20 countries including the UK. Koinly helps UK citizens calculate their crypto capital gains.

TikTok video from Blockchain And Beyond blockchainandbeyond. You can also generate an Income report that shows your income from Mining Staking Airdrops Forks etc. CoinTrackinginfo - the most popular crypto tax calculator.

It allows you to calculate the profit and loss from cryptocurrency trading calculate capital gains or losses and take deductions on expenses. When you sell an asset for a price lower than when you bought it this is recorded as a capital loss. As with any investment it is subject to tax rules.

That means you calculate your capital gains and if the result is below the limit you dont need to. Straightforward UI which you get your crypto taxes done in seconds at no cost. Income report - Mining staking etc.

Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales you made this financial year. Use our Crypto Tax Calculator. We then re-buy the BTC in the next financial year with the new average cost basis being.

CryptoTraderTax is the easiest and most intuitive crypto tax calculating software. Automated Crypto Trading With Haru. This calculator only provides an indicative estimate based on data you have input and the tax brackets and rates found on the ATO website and does not.

CoinLedger is the fastest and easiest crypto tax calculator. In the UK you only pay Capital Gains Tax if your overall gains for the tax year after deducting losses are above the Annual Exempt Amount AEA. Every transaction can be adjusted or tailored using the Grand Unified Accounting GUA spreadsheet to fit the investors best possible tax outcome using their preferred accounting method.

Tax doesnt have to be taxing. Automatically calculate crypto tax. It serves as a one-stop shop to handle cryptocurrency tax reporting for all types of cryptocurrency use cases whether you are mining staking lending or simply buying or trading CryptoTraderTax will automate your tax reporting.

Gifts to charity are also tax-free details. ZenLedger is much more than just a free crypto tax calculator. Here are our Top Picks for Crypto Tax Calculators.

What if the cryptocurrency tax calculator shows a loss. This allowance was 12500 for the 20202021 tax year. Full integration with popular exchanges and wallets in Canada with more jurisdictions to come.

Find the highest rated crypto tax software in the uk pricing reviews free demos trials and more. The original software debuted in 2014. Purchase 1 bitcoin BTC for 100 and then sell it for 10000.

Calculating cryptocurrency in the UK is fairly difficult due to the unique. Allowances for tax-free capital gains in the UK by year source Cryptocurrency gifts to your spouse are also non-taxed and can effectively allow you to double your tax-free allowance in a given tax year. CryptoTraderTax is now CoinLedger.

The platform has made the entire process hassle-free by integrating with almost every crypto exchange out there. If you have the calculator will automatically apply a 50 discount to your capital gain. How to use a crypto tax calculator to calculate your crypto taxes.

Resources guides How to calculate your UK crypto tax. It helps you calculate your capital gains using Share Pooling in accordance with HMRCs guidelines.

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Calculate Your Crypto Taxes With Ease Koinly

Germany Crypto Tax Guide 2022 Koinly

Bitcoin Hard Fork Current Bitcoin Exchange Rate Cryptocurrency Masternode How Is Bitcoin Valued Bitcoin For Usd Bitcoin Bitcoin Price Cryptocurrency Trading

Bitmarket Is Clean And Modern Design Responsive Html Template For Bitcoin Crypto Currency Exchange And Trading Company W Templates Cryptocurrency Bitcoin

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Germany Crypto Tax Guide 2022 Koinly

Capital Gains Tax Calculator Ey Global

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Crypto Tax In 2020 A Comprehensive Guide En 2020 Guide Autorite

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Learn To Trade Bitcoin For Free Bitcoin Price Bitcoin Bitcoin Mining

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Cryptocurrency Tax Guides Help Koinly

Ripple Xrp 200 Companies In Ripplenet 7th In The Ranking And New Office In Dubai Ripple Bitcoin Cryptocurrency

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare